Atlas Crest Investment

Atlas Crest Investment Corp., also called Atlas Crest Investment, is a blank check company. It was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. The company was founded on August 26, 2020 and is headquartered in New York, NY. The listed name for ACIC is Atlas Crest Investment Corp

Financials

Atlas Crest priced its $500 million initial public offering on October 27, 2020. This is another new public company. Not much to be said about the financials except that it grew to roughly 800+M since its initial offering.

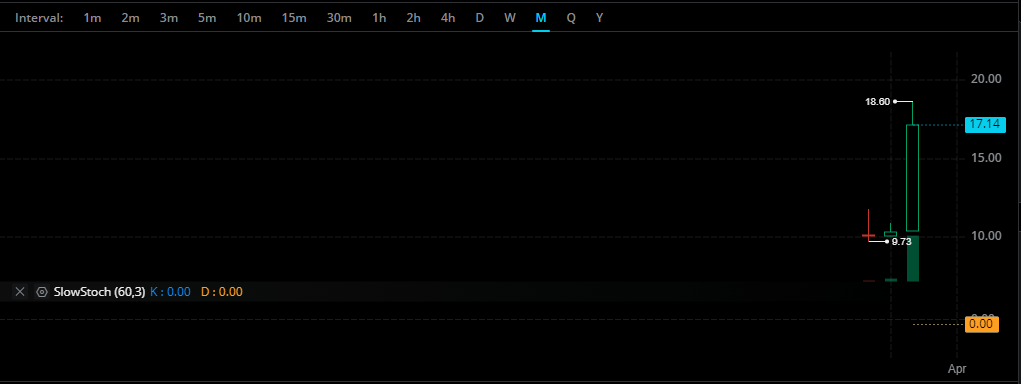

Support and Resistance

As you can see this stock has only been on the market for a few months. But has shown huge upside potential. Even through the recent pullback this week

If this stock were to be analyzed to have a support area we it would be in the $9 – $10 range. As you can see that is a mark that is a distant memory from now.

So far, we have seen resistance at the $18 level. This could be from the recent market dip. I good resistance mark would be $16 – $18 area. at least so far as it seems in the beginning.

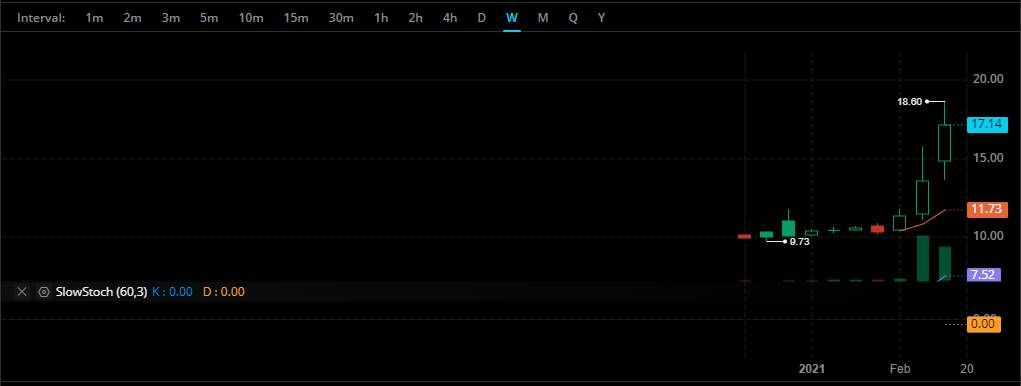

Weekly Chart.

The weekly chart for ATLAS CREST INVESTMENT CORP. is just starting to show 8MA trend line.

Of course, as you would expect, with this growth it is trending upward. Also you will notice the distance of this trend.

Just something to be careful of if investing.

Not much to be said here but great DD for those who got in early.

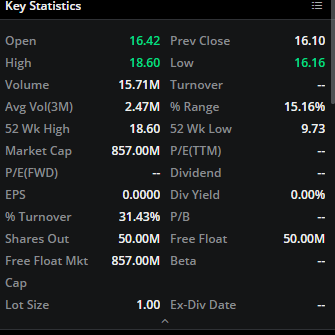

$ACIC Key Statistics

Some notable stats here is the market cap of 857M. This is up 357M from its entery into the market.

One factor to consider is not the shorts just waiting for a opportunity to jump on this. Given that there is 50M free float this number is also enticing.

Be aware and do some DD.

Also loving the low volume this is another reason why this stock can fly so quick.

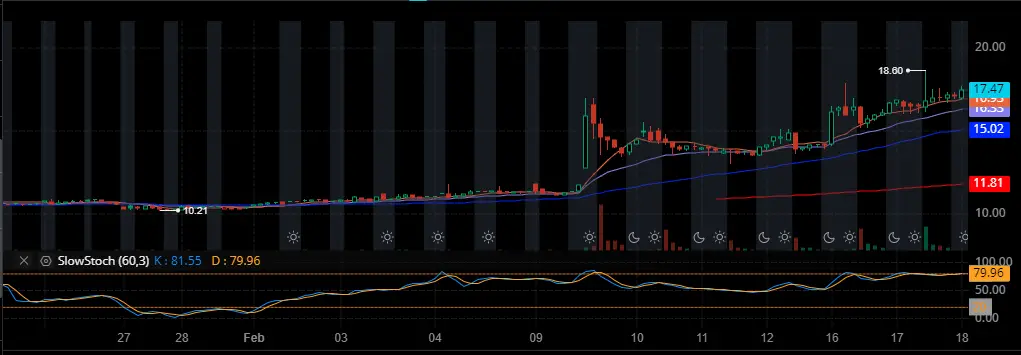

2HR Chart

Yes, the 2hr chart among the favorites of a swing trader. Plenty of information here.

$11+ support level for the 200MA. not bad given that the stock came out flat at $9

$14 support level at the 50MA. This would be my start watching and getting ready to possibly buy a dip level. Plenty of strong support.

On another good note. the 20EMA has been consistent bounce support since price has crossed.

Final Thought.

This is a SPAC heavy time. many investors have at least 20% tucked away in these gems.

Be careful this stocks are highly volatile. SO it is highly recommended to take profit and take it early.

Now you need to do your own DD. This is based primarily off pure techicals.

Since. this has been a profit taking week. You might want to tuck some away here unless you are going the Bond route.

Disclaimer

NOT INVESTMENT ADVICE

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by HII or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. HII is not a fiduciary by virtue of any person’s use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold HII, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.

INVESTMENT RISKS

There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.