C3.ai

C3.ai, Inc. provides enterprise artificial intelligence (AI) software for digital transformation. It delivers the C3 AI suite for developing, deploying, and operating large-scale AI, predictive analytics, and Internet of Things (IoT) applications in addition to a portfolio of turn-key AI applications. The company was founded by Thomas M. Siebel, Patricia A. House and Stephen Maurice Ward, Jr. on January 8, 2009 and is headquartered in Redwood City, CA. The listed name for AI is C3.ai, Inc.

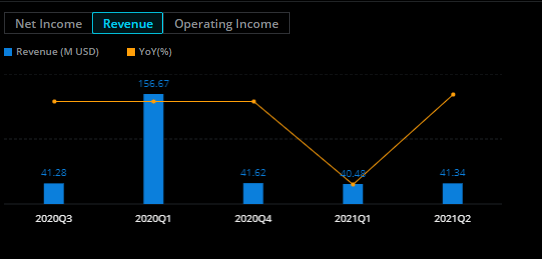

Financials

C3.ai has been growing greatly over the past quarters.

Although, Then slowing down when the pandemic hit.

This company has a good opportunity for growth during this time.

Due to the need for artificial intelligence in the warehouse sector due to the huge growth in online shopping.

Revenue has increased year over year.

Adding more innovations in technology. Plus coupled with the need for more automation in certain sectors, this has great potentials to continue to grow.

support and resistance

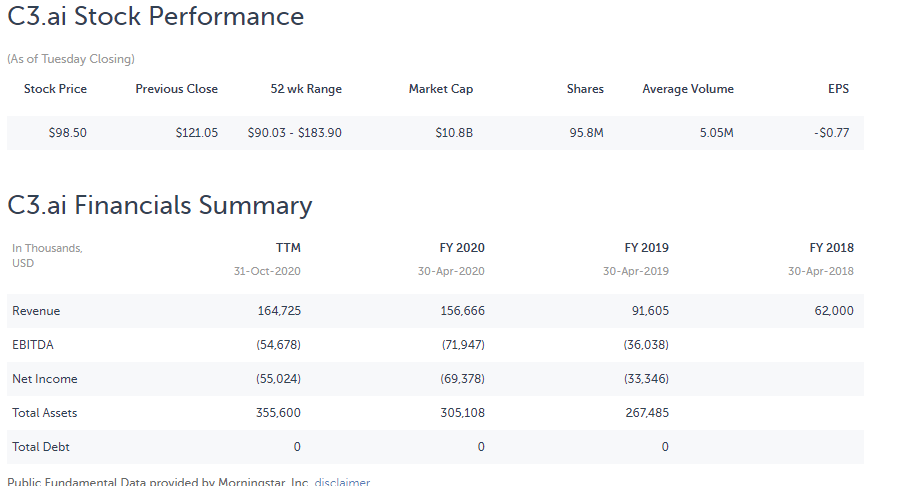

Looking at the daily chart and given the most recent selloff of the market. AI has came down to almost initial levels. This is a good area to get into a company that has a business model fit for the changing innovations to come.

The current price is well below the 20ema, 50ma, and the 200ema.

this is very good it will has some levels of resistance to get back to it height.

You need to take into account the current state of market sentiment, the Corona virus and Congress approval of new stimulus.

these will play immediate affect on the current price in the near future.

Average analysis has $AI at approx $120+ and so this has definite immediate possible growth.

1HR Chart

This 1hr chart goes back to december of 2020, at it’s height of $183. Then showing a pullback and then finding more support at the $150 level.

the more recent selloff has sent this stock into bearish territory.

if you are bullish in technology and this stock in-particular this is a good time to start looking at averaging in.

Of course no-one knows where the bottom is. C3.ai is a stock is nearing its original support in the $90+ area.

The senate is looking to possibly approve some kind of stimulus and with the 10yr treasury looks to be declining soon.

With positive news on either of these areas should drive a more bullish sentiment into this stock. With opposite news we could always have the latter.

final Thought

Investing in a choppy market can always have some disadvantages.

If you are looking for a long term investment, to hold at a lesser over-valuation.

(most stocks currently over-valued) with some near upside potential.

Disclaimer

NOT INVESTMENT ADVICE

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by HII or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. HII is not a fiduciary by virtue of any person’s use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold HII, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.

INVESTMENT RISKS

There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.