Grupo Supervielle

Financials-Banking & Investments services

Grupo Supervielle SA operates as a holding company. The firm engages in the provision of banking services. It operates through the following segments: Retail Banking, Corporate Banking, Treasury, Consumer, Insurance and Asset Management and Other Services. The Retail Banking segment involves in granting of loans and other credit products such as deposits of physical persons. The Corporate Banking segment focuses in advisory services at a corporate and financial level, as well as the administration of assets and loans targeted to big clients. The Treasury segment operates with Government Securities of the Group, syndicated loans, and financial lease. The Consumer segment consists of loans and other credit products targeted to middle and lower-middle income sectors and non-financial products and services. The Insurance segment comprises insurance products, with a focus on life insurance. The Asset Management and Other Services segment offers mutual funds and other products and services. The company was founded on October 8, 1979 and is headquartered in Buenos Aires, Argentina. The listed name for SUPV is Grupo Supervielle S.A.

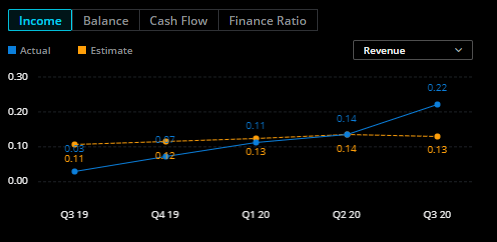

Financials

Since Q1 20 (starting of the pandemic) this company has made major efforts into creating cash flow and generating revenue. Two good items to see in a company that has made adjustments and has a plan for growth.

Support and Resistance

This stock is showing healthy resistance at the $1.50 -$2 level. Resistance doesn’t show until the $3+ level.

Weekly Chart

on this weekly chart you can see that once this stock breaks past the 20ema there is no clear resistance. of course this is dependant upon the shorts that are in here. (we will cover that later.)

The weekly $SUPV RSI still has plenty of room to grow.

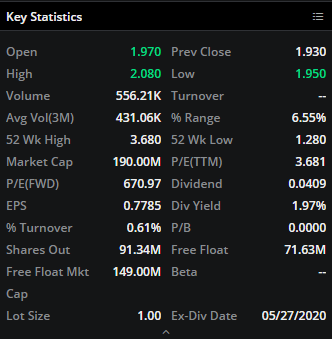

$SUPV Key Statistics

Stochastics is high but with the MACD cross, market cap of 190M and a free float of just 71M, this has potential.

2HR Chart

As you can see on the 2HR chart this stock has gained quite the momentumm and just got the positive MACD cross.

RSI is still somewhat high but the MACD shows plenty of room.

final Thought

this is a great opportunity to bring in 50% + on a relatively short lived investment. Grupo Supervielle has great opportunities for growth in the long run so taking some profit and investing for a long term can be a good idea.

The Banking/Investment sector still has room for growth. More and more investors for stocks, bonds, real estate are coming into play.

This is definitely a sector that can see a huge upside going into a more relaxed (back to business) economy.

Disclaimer

NOT INVESTMENT ADVICE

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by HII or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. HII is not a fiduciary by virtue of any person’s use of or access to the Site or Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold HII, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.

INVESTMENT RISKS

There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.